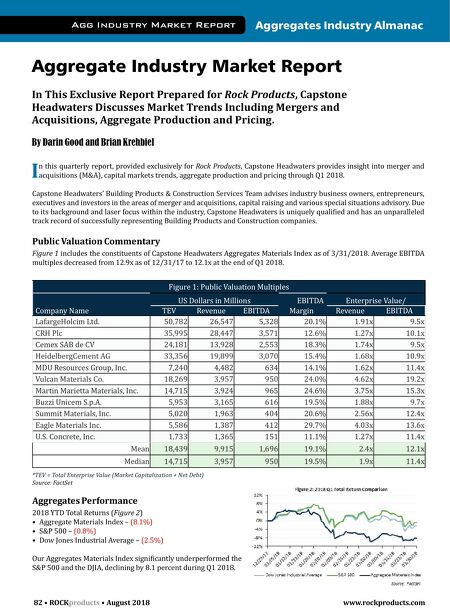

Rock Products is the aggregates industry's leading source for market analysis and technology solutions, delivering critical content focusing on aggregates-processing equipment; operational efficiencies; management best practices; comprehensive market

Issue link: https://rock.epubxp.com/i/1008221

www.rockproducts.com ROCK products • August 2018 • 83 Aggregates Industry Almanac Agg Industry Market Report M&A; OVERVIEW Preliminary estimates of total acquisition activity (Figure 3) in Q1 2018 indicate a decrease of 34.1 percent compared to the same period in 2017 in terms of the number of aggregates related transactions completed (27) in the United States and Canada. Transaction activity was also down 15.6 percent compared to Q4 2017. It is common for transaction activity to dip in Q1 after a large transaction push at year-end. Publicly traded aggregates producers were notably active during the quarter, including Summit Materials, US Concrete and Vulcan Materials. Figure 3: Select Q1 2018 Industry M&A; Activity Transaction Date Target/Issuer Buyers/Investors Transaction Value ($mm) 03/29/18 Lehigh White Cement Co. Cemex Inc. $140.6 03/28/18 McCartney Construction Co. Inc. Vulcan Materials Co. - 03/28/18 Hormigones Independencia S.A. Unión Andina de Cementos S.A.A. $22.2 02/28/18 McAsphalt Industries Limited Colas Canada Inc. $728.5 02/14/18 Metro Readymix, LLC Summit Materials Inc. - 02/14/18 Price Construction Co. Summit Materials Inc. - 02/14/18 Mertens Construction Co. Summit Materials Inc. - 01/17/18 Halla Cement Corp. Asia Cement Co. Ltd. $532.2 01/10/18 On Time Ready-Mix Inc. U.S. Concrete Inc. - 01/03/18 A.H. Harris & Sons Inc. HD Supply Construction Supply Ltd. $380.0 01/02/18 Cementir Italia SpA Italcementi SpA $377.1 Sources: FactSet and Capital IQ Private Equity Transaction Activity and Valuations GF Data Resources, a provider of detailed information on business transactions ranging in size from $10.0 million to $250.0 million, provides quarterly data from over 201 private equity firm contributors on the number of completed transactions. Figure 4 provides the number of completed transactions from GF Data contributors, the average Total Enterprise Value (TEV)/EBITDA multiple, and the average amount of debt utilized in the transaction computed as a multiple of EBITDA. The data, although not industry specific, shows valuations declining sharply from record levels achieved during the prior quarter. Figure 4: Private Equity Valuations & Leverage Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 # of Transactions 50 76 36 58 64 52 51 69 52 TEV/EBITDA 6.5x 7.1x 6.6x 6.7x 6.6x 7.4x 7.5x 8.0x 6.9x Total Debt/EBITDA 4.4x 4.0x 3.8x 3.7x 4.0x 4.4x 4.5x 4.3x 4.2x Senior Debt/EBITDA 2.8x 3.3x 3.2x 2.8x 3.0x 3.6x 3.7x 3.5x 3.4x Source: GF Data Notable Transactions Several notable transactions were completed or announced in the industry during Q1 2018. One of the more notable aggre- gates industry transactions is highlighted below. Colas Canada, Inc. acquired Miller Paving Ltd. and McAsphalt Industries Ltd. (Feb. 28, 2018, $728.0 million). Colas Canada has acquired the Miller McAsphalt Group for $728.0 million. The Miller McAsphalt Group is a major player in road construction and bitumen distribution in Canada, with a strong foothold in Ontario. Acquires